What percentage of your clients- I'm just curious- wait until the last second to get their stuff in? I mean, it's interesting to me that people still- people still do that, don't they? They wait until the last second. JULIE HYMAN: It's funny, Brian Sozzi did not tell you, but his father- oh, his father- his brother is a CPA as well and apparently just messaged him and said, tell people don't procrastinate. And I understand taxes are not the most fun thing to think about throughout the year, but if at a minimum, you could reach out, and let's have a discussion in November or December, at least, then you can plan accordingly from a liquidity standpoint, and you're not surprised right now. But at a minimum, you just want to make sure that you are not surprised in April of 2023. It may mean that you have to increase your estimated tax payments if you pay estimates quarterly. It may mean that you have to increase your withholdings from your salary if you're a W-2 person. So that means if you're reviewing your statements or you're having semi-monthly meetings with your investment advisor, ask the questions to say, what is this going to mean, come tax time, to me? So make sure that if you work with a tax professional, even if it's at your end, do whatever planning you need to do in order to make sure that you're not surprised come tax time. It all- honestly, Brian, it all goes to planning. And that's coming as a surprise to many, as they're finalizing their tax returns over the coming weeks.īRIAN SOZZI: Kim, what steps should investors be taking today to avoid these surprises next year? So we are dealing with the same rates, same capital gains rates, same ordinary rates, but much more income than maybe investors have seen in prior years.

And just to be clear, I know there were a lot of rumblings that later in 2021, that we could have had a new tax plan.

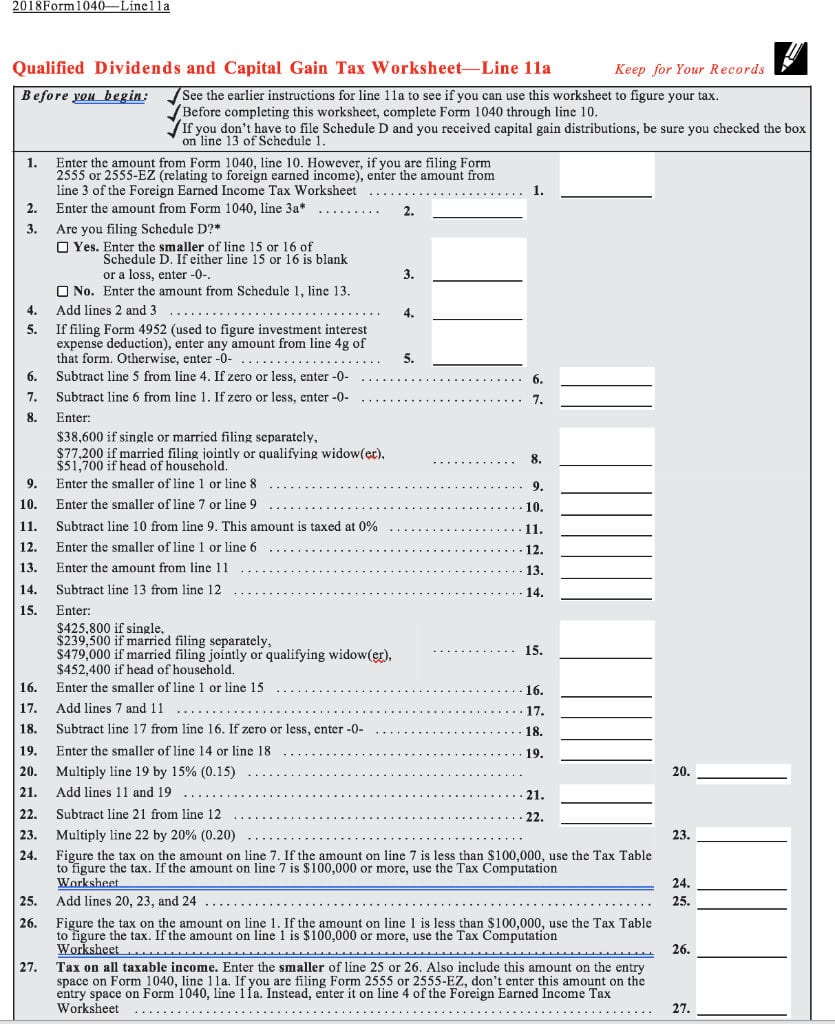

#CANADA FEDERAL BUDGET 2021 CAPITAL GAINS TAX DRIVER#

But capital gains, I would say, is the biggest driver right now. So there's a lot of very surprised individuals right now, especially with two weeks to go, who find that they have larger tax bills and then payments to make. And now when people are getting their 1099s, they're seeing this larger amount of income that now they're paying taxes. And unfortunately, those don't get paid out until the end of the year. And for the last several years, we haven't seen big capital gain distributions come through until 2021. So whether if they chose to sell securities through their portfolios in order to make sure that they're getting, you know- they were able to take advantage of the markets or for those who are invested in mutual funds, there's something called capital gains distributions. And now what they're coming to find is now it's time to pay tax on those gains. Much of it has to do with the market and the fact that the market was very, very good in 2021, and people recognized substantial capital gains. KIM DULA: So far, what we're seeing- and you are 100% correct, Julie- many people are finding that they have tax liabilities when they're getting their tax returns prepared this year.

0 kommentar(er)

0 kommentar(er)